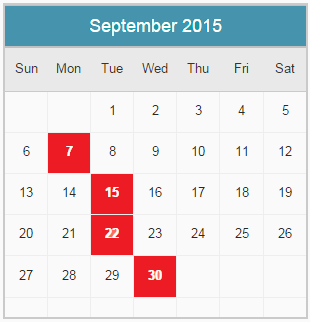

Due Dates for selected month and year

7 September 2015 -

Due date for deposit of Tax deducted/collected for the month of August, 2015

15 September 2015 -

First instalment (in the case of a non-corporate assessee) or second instalment (in the case of a corporate-assessee) of advance income-tax for the assessment year 2016-17

22 September 2015 -

Due date for issue of TDS Certificate for tax deducted under Section 194-IA in the month of August, 2015

30 September 2015 -

Audit report under Section 44AB for the assessment year 2015-16 in the case of a corporate-assessee or non-corporate assessee (who is required to submit his/its return of income on September 30, 2015)

30 September 2015 -

Statement by scientific research association, university, college or other association or Indian scientific research company as required by rules 5D, 5Eand 5F (if due date of submission of return of income is September 30, 2015)

30 September 2015 -

Annual return of income and wealth for the assessment year 2015-16 if the assessee (not having any international or specified domestic transaction) is (a) corporate-assessee or (b) non-corporate assessee (whose books of account are required to be audited) or (c) working partner (of a firm whose accounts are required to be audited)

30 September 2015 -

Audit report under section 44AB for the assessment year 2015-16 in the case of a corporate-assessee or non-corporate assessee (who is required to submit his/its return of income on September 30, 2015)